The Only Guide to Pvm Accounting

The Only Guide to Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsThe Facts About Pvm Accounting UncoveredThe Basic Principles Of Pvm Accounting The Best Strategy To Use For Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Ultimate Guide To Pvm Accounting8 Simple Techniques For Pvm Accounting

Oversee and handle the creation and authorization of all project-related billings to customers to cultivate great interaction and stay clear of issues. construction taxes. Guarantee that ideal reports and documentation are submitted to and are updated with the internal revenue service. Guarantee that the bookkeeping procedure follows the law. Apply called for building accountancy standards and procedures to the recording and coverage of construction activity.Communicate with numerous funding firms (i.e. Title Company, Escrow Company) relating to the pay application procedure and demands required for payment. Assist with carrying out and keeping interior economic controls and procedures.

The above declarations are planned to describe the general nature and degree of job being carried out by people designated to this category. They are not to be interpreted as an extensive checklist of obligations, obligations, and abilities needed. Employees might be required to do duties beyond their typical obligations every now and then, as needed.

5 Easy Facts About Pvm Accounting Shown

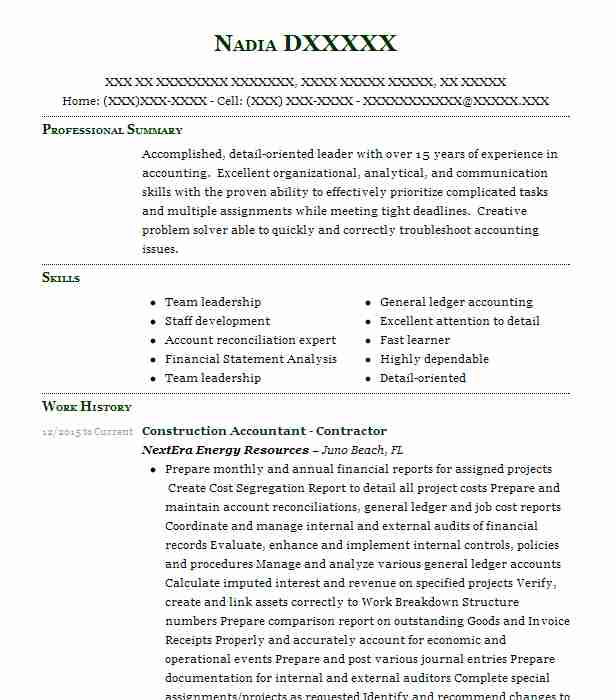

Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building Accounting professional carries out a selection of audit, insurance coverage conformity, and job administration.

Principal duties include, but are not restricted to, taking care of all accounting features of the company in a timely and exact manner and supplying records and timetables to the firm's CPA Firm in the preparation of all monetary declarations. Ensures that all accounting procedures and features are handled properly. In charge of all monetary records, pay-roll, banking and daily operation of the bookkeeping function.

Functions with Task Supervisors to prepare and post all monthly invoices. Produces monthly Work Cost to Date reports and functioning with PMs to integrate with Project Supervisors' budgets for each job.

About Pvm Accounting

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Workplace) and Procore construction management software an and also. https://www.wattpad.com/user/pvmaccount1ng. Have to likewise be skillful in other computer software program systems for the preparation of records, spread sheets and other accountancy analysis that may be needed by administration. Clean-up accounting. Need to possess solid organizational abilities and capability to focus on

They are the financial custodians that guarantee that building projects remain on budget, abide by tax laws, and preserve economic transparency. Building accountants are not just number crunchers; they are calculated partners in the building procedure. Their primary function is to take care of the economic elements of construction jobs, guaranteeing that sources are assigned successfully and monetary threats are decreased.

Rumored Buzz on Pvm Accounting

They work very closely with project managers to create and keep an eye on budget plans, track expenses, and forecast monetary needs. By keeping a limited hold on project financial resources, accountants help prevent overspending and financial setbacks. Budgeting is a keystone of effective their explanation construction jobs, and construction accounting professionals are crucial hereof. They develop comprehensive budget plans that incorporate all task costs, from products and labor to licenses and insurance policy.

Construction accounting professionals are skilled in these guidelines and guarantee that the project complies with all tax obligation demands. To excel in the role of a building and construction accountant, individuals require a solid instructional structure in bookkeeping and money.

In addition, qualifications such as Cpa (CPA) or Qualified Construction Sector Financial Professional (CCIFP) are extremely pertained to in the market. Functioning as an accountant in the building sector features a distinct collection of difficulties. Building tasks typically entail limited target dates, transforming policies, and unexpected expenditures. Accounting professionals must adapt rapidly to these obstacles to maintain the job's financial health intact.

Fascination About Pvm Accounting

Ans: Building accounting professionals create and check budget plans, determining cost-saving chances and ensuring that the project stays within spending plan. Ans: Yes, construction accountants take care of tax obligation compliance for construction tasks.

Intro to Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction companies have to make difficult options amongst lots of monetary alternatives, like bidding on one project over another, choosing financing for materials or equipment, or setting a job's revenue margin. Building is a notoriously unstable industry with a high failing price, sluggish time to payment, and irregular cash money flow.

Normal manufacturerConstruction business Process-based. Production involves duplicated procedures with quickly recognizable prices. Project-based. Manufacturing calls for various processes, materials, and tools with differing prices. Dealt with location. Manufacturing or production happens in a single (or several) controlled locations. Decentralized. Each project happens in a new place with differing website conditions and unique difficulties.

The smart Trick of Pvm Accounting That Nobody is Discussing

Durable relationships with vendors reduce settlements and improve efficiency. Irregular. Frequent usage of different specialized specialists and suppliers influences effectiveness and capital. No retainage. Settlement shows up completely or with regular payments for the full agreement quantity. Retainage. Some section of settlement might be withheld till task conclusion even when the professional's work is ended up.

Routine production and temporary agreements bring about workable cash circulation cycles. Irregular. Retainage, slow settlements, and high in advance prices bring about long, irregular cash circulation cycles - construction accounting. While traditional suppliers have the advantage of regulated atmospheres and maximized production processes, construction business have to continuously adjust to each brand-new task. Also somewhat repeatable tasks require adjustments due to site problems and other factors.

Report this page